The Pros, Cons, and Economic Impacts: Analyzing the Ban on ₹2000 Note by the Indian Government

Banning the ₹2000 note by the Indian government would have both pros and cons, along with potential impacts on the Indian economy. Here is a brief overview:

Pros:

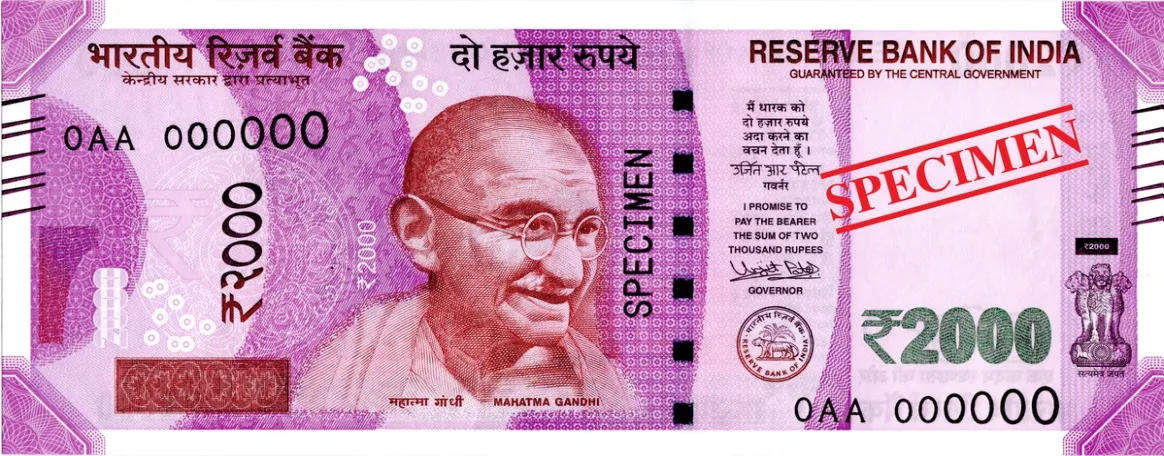

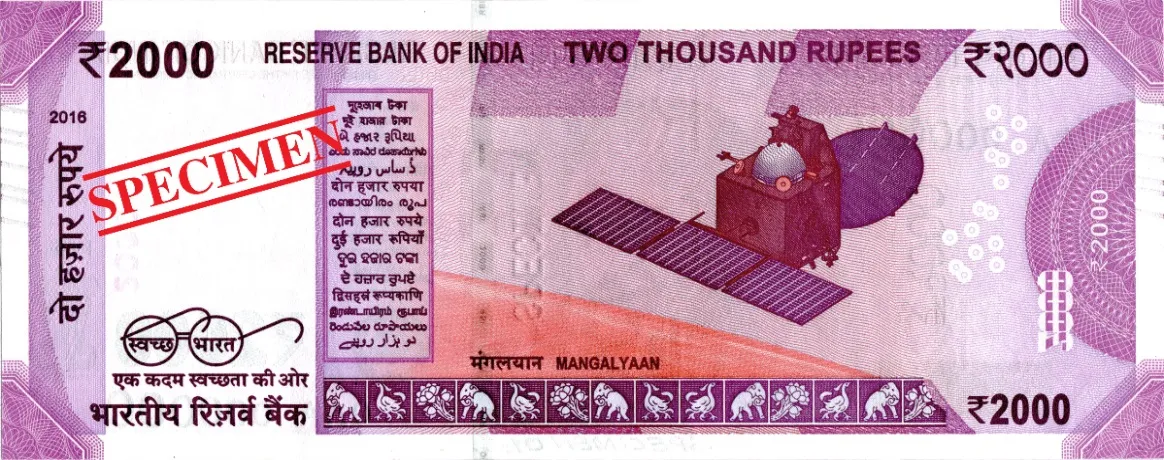

Curbing black money: One of the primary reasons for banning high-denomination notes like the ₹2000 rupee note is to combat the issue of black money. It can help reduce illicit activities such as tax evasion, corruption, and illegal transactions as it becomes more difficult to hoard large sums of cash.

Reducing counterfeit currency: The ban can aid in reducing the circulation of counterfeit ₹2000 notes, as these high-value denominations are often targeted by counterfeiters. By eliminating the note, the government can potentially tackle this problem effectively.

Promoting digital transactions: The ban on the ₹2000 note can encourage the adoption of digital payment systems. With limited availability of cash in larger denominations, individuals may be more inclined to use electronic modes of payment, promoting a shift towards a cashless economy.

Cons:

Inconvenience to the public: Banning the ₹2000 note can initially cause inconvenience to the general public, particularly those who rely heavily on cash transactions. The sudden unavailability of the note might disrupt daily activities and require time for individuals to adapt to alternative payment methods.

Impact on informal economy: The informal sector in India, which largely operates on cash transactions, could face significant disruptions due to the ban. Small businesses and individuals in rural areas might struggle with the transition, affecting their livelihoods in the short term.

Cost of implementation: Banning a currency note involves costs related to printing and distributing new denominations, as well as recalibrating ATMs and other cash handling machines. These expenses can put a strain on the government's resources

Prospects in the Indian Economy:

The ban on the ₹ 2000 note can have various impacts on the Indian economy, including:

Increased tax compliance: With a reduction in black money, the government's tax base may expand, leading to higher tax revenues. This can positively impact public finances and contribute to funding developmental projects.

Boosting digital payments: The move can accelerate the shift towards digital transactions, fostering financial inclusion and reducing the reliance on cash. This can improve transparency in the economy and enhance the efficiency of payment systems.

Encouraging formalization: By discouraging cash-based transactions, the ban can encourage greater formalization of the economy. Increased transparency can lead to better financial records, improved access to credit, and enhanced economic stability.

Short-term disruptions: In the short term, the ban might cause temporary disruptions to economic activities, particularly in sectors relying heavily on cash transactions. However, as the economy adjusts, the potential long-term benefits mentioned above could outweigh these initial challenges.

It's important to note that the actual impact of banning the ₹2000 note would depend on various factors, including the implementation strategy, the government's accompanying measures, and the response of the public and businesses to the policy change.

As a business chamber, the International Federation of Business Intellectuals & Changemakers (IFBIC) can provide its members with valuable lessons from the demonetization process and guide them on how to navigate the potential impact of banning the ₹2000 currency. Here are some key points for IFBIC members to consider:

Lessons from Demonetization:

Adaptability and preparedness: Demonetization highlighted the importance of being adaptable and prepared for sudden policy changes. Businesses should have contingency plans in place to mitigate disruptions and minimize potential losses during such events.

Embracing digital transformation: The demonetization exercise emphasized the need for businesses to embrace digital transformation and promote cashless transactions. IFBIC members should explore and adopt digital payment solutions to ensure smooth operations and customer convenience.

Diversification of revenue streams: Businesses heavily reliant on cash transactions were particularly affected by demonetization. IFBIC members should diversify their revenue streams, explore alternative payment options, and identify opportunities in emerging sectors to reduce dependency on cash-based operations.

Impact of Banning ₹2000 Rupee Currency:

Short-term disruptions: Banning the ₹2000 currency note may cause short-term disruptions in the economy, affecting businesses that rely on large cash transactions. Members should anticipate potential challenges in cash flow, inventory management, and customer spending patterns during the transition period.

Emphasize digital and alternative payment options: IFBIC members should proactively promote and educate their customers about digital payment alternatives and encourage their adoption. This can help minimize the impact of the currency ban and ensure continuity in business operations.

Strengthen financial management: Given the potential impact on cash flow, members should focus on strengthening their financial management practices. This includes maintaining adequate working capital, revising budgets, and exploring financing options to mitigate any temporary liquidity challenges.

Collaborate and share best practices: IFBIC can play a crucial role in facilitating knowledge-sharing among its members. Collaborative efforts, sharing best practices, and exchanging experiences related to adapting to the currency ban can benefit the entire business community.

Monitor policy changes: IFBIC members should closely monitor government policies and regulations concerning currency ban, digital payments, and financial inclusion. Staying informed and actively participating in policy discussions can help shape a conducive business environment and address any challenges that may arise.

It's important for IFBIC members to understand that the impact of banning the ₹2000 currency will vary across sectors and individual businesses. Adapting to the changes, embracing digital solutions, diversifying revenue streams, and maintaining financial resilience will be essential for navigating the transition successfully and ensuring long-term sustainability.